Life is full of unexpected twists and turns. With Supplemental Life Coverage, you can add an extra layer of financial security to your existing insurance plan. Supplemental life insurance acts as an additional safety net, providing coverage beyond your primary life insurance policy. Whether you’re looking to increase your death benefit coverage, add coverage for specific needs like critical illness or long-term care, or enhance your family’s financial protection in the event of disability, Lily Insurance has you covered.

With Lily Insurance, you can rest assured knowing that you and your loved ones are protected against life’s uncertainties. Our dedicated team of advisors is here to help you navigate your supplemental life insurance options and find the right coverage to complement your existing policy.

Maintaining good oral health is essential for overall well-being, but unexpected dental expenses can quickly add up. At Lily Insurance, we offer comprehensive dental coverage that helps you stay on top of routine care while also protecting you from the high costs of more extensive treatments. Our plans are designed to fit various needs and budgets, so you can choose the coverage that best suits you and your family. With access to a wide network of dentists and a range of benefits, you can keep smiling confidently, knowing your dental health is in good hands.

Your vision is a critical part of your quality of life, yet eye care can often be overlooked. Lily Insurance provides vision coverage that makes it easy and affordable to prioritize your eye health. From routine eye exams to prescription glasses and contact lenses, our plans ensure that you have the support you need to maintain clear and healthy vision. With flexible options to choose from, you can find the right plan that meets your lifestyle and budget. Protect your sight and enjoy the view—let us help you see clearly, every step of the way.

A hospital stay, whether planned or unexpected, can disrupt your life and finances. Lily Insurance’s hospital indemnity coverage is here to ease the burden, providing you with a daily cash benefit for each day you’re in the hospital. This benefit can be used for anything from medical bills to household expenses, giving you the flexibility to manage your finances during a challenging time. Our plans are designed to complement your existing health insurance and provide an additional layer of security. Protect yourself and your loved ones from the unexpected financial impact of a hospital stay.

Accidents happen when we least expect them, and the resulting medical bills can be overwhelming. With Lily Insurance’s accident coverage, you can have peace of mind knowing that you’re financially protected from the unexpected. Our plans provide benefits that help cover medical expenses, hospital stays, and even recovery costs after an accident. Whether it’s a minor mishap or a more serious injury, you can focus on healing without the added stress of unexpected expenses. Choose the coverage that best suits your needs and let us help safeguard your financial well-being.

A serious illness like a heart attack or stroke can turn your life upside down in an instant. Lily Insurance’s critical illness coverage offers a lump-sum benefit that can be used for medical treatment, rehabilitation, or even daily expenses like mortgage payments and childcare. Our plans provide you with the financial support you need to focus on your recovery and reduce the stress of unexpected costs. With flexible options and a range of covered conditions, you can choose the plan that best supports your health journey. Protect yourself and your loved ones from the financial impact of a critical illness.

A cancer diagnosis can be life-changing, both emotionally and financially. At Lily Insurance, we offer specialized cancer coverage designed to provide financial support when you need it most. Our plans offer benefits that can be used for medical expenses, treatments, and even everyday living costs, helping you focus on your health and recovery. With customizable options to fit your budget and needs, you can feel secure knowing you have a financial safety net in place. Take a proactive step in your health journey and ensure you’re prepared for whatever the future may hold.

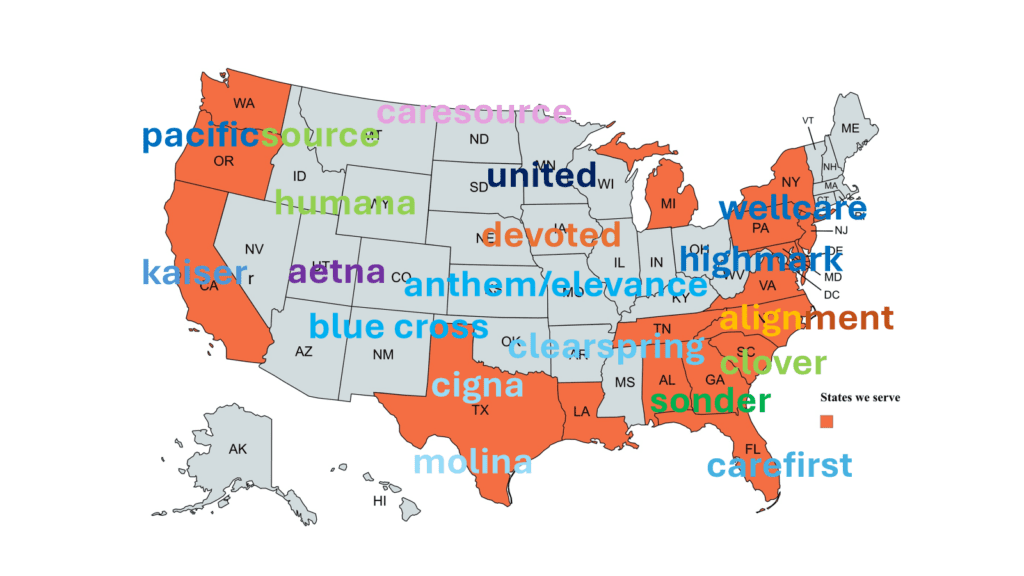

AL NY CA OR DE PA FL SC GA

TN LA TX MD WA MI NC NJ

Offices –

Charlotte, NC- 980-288-5798

Atlanta, GA – 678- 341-0931

Daytona, FL – 386-243- 2927

Knoxville, TN –

Dallas, TX –

Gathersburg, MD –

Portland, OR –

We do not offer every plan available in your area. Currently we represent 12 organizations which offer 51+ products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Aetna HUMANA Anthem KAISER Alignment MEDICO BCBS NC MOLINA Carefirst PacificSource Cigna PEOPLES HEALTH/UHC Clover SONDER Devoted UHC Highmark WELLCARE/CENTENE