Our customers trust Lily Insurance with their life insurance needs and know that we care about them. Give us a call to schedule a meeting or click the link below to get a quote today.

Planning for end-of-life expenses is a thoughtful and responsible act that can provide immense relief to your loved ones during a difficult time. Lily Insurance understands the importance of ensuring that your final wishes are honored without adding financial strain to those you care about most. By securing this coverage now, you can spare your family from the burden of these expenses later on.

You have the flexibility to choose a final expense policy that meets your needs and fits your budget. Our compassionate advisors are here to assist you every step of the way, offering personalized guidance and support as you navigate this important decision. Take the proactive step towards providing your loved ones with peace of mind and financial security during a challenging time.

Looking to secure lifelong protection while building cash value over time? Universal life insurance offers both death benefit coverage and a cash value component, providing you with flexibility and control over your policy.

Our experienced advisors are here to guide you through the intricacies of universal life insurance, helping you understand how it can benefit you and your loved ones. Whether you’re seeking to protect your family’s financial future or leaving a legacy for future generations, universal life coverage from Lily Insurance can help you achieve your goals. Take control of your financial future with Lily Insurance universal life coverage. Explore your options today and embark on a journey toward lasting financial security and peace of mind.

Looking for a life insurance solution that provides permanent coverage, cash value accumulation, and guaranteed premiums? Whole life insurance provides coverage for your entire life, ensuring that your loved ones are protected no matter what the future holds. With Lily Insurance, you can rest assured knowing that your policy’s premiums will remain consistent throughout your lifetime, offering stability and predictability.

In addition to death benefit protection, whole life insurance also accumulates cash value over time, which you can access for various financial needs, such as supplementing retirement income or covering unexpected expenses.

Our knowledgeable advisors are here to assist you in understanding the benefits of whole life insurance and tailoring a policy to meet your specific needs and goals. With Lily Insurance, you can take the proactive step towards securing a legacy of financial security and peace of mind for yourself and your loved ones.

Term life insurance offers straightforward protection for a specified period, ensuring that your family is safeguarded in the event of your unexpected passing. You can choose the coverage term that aligns with your needs, whether it’s 10, 20, or 30 years.

Our experienced advisors are here to help you navigate your options and find the term life policy that fits your lifestyle and budget. Don’t leave your family’s future to chance. Take the proactive step towards ensuring their financial well-being with Lily Insurance. Get started today and gain the peace of mind knowing that your loved ones are protected, no matter what tomorrow may bring.

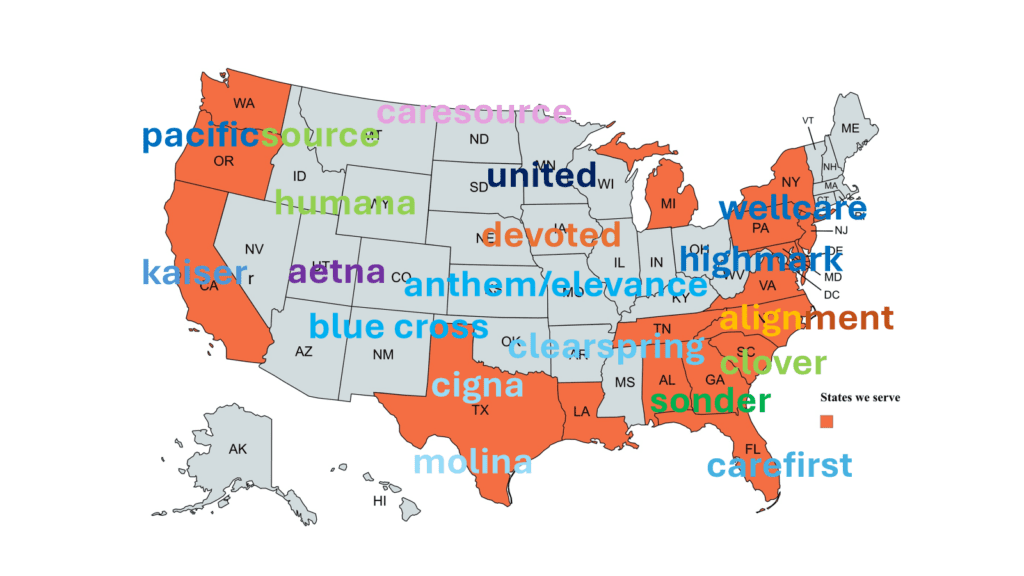

AL NY CA OR DE PA FL SC GA

TN LA TX MD WA MI NC NJ

Offices –

Charlotte, NC- 980-288-5798

Atlanta, GA – 678- 341-0931

Daytona, FL – 386-243- 2927

Knoxville, TN –

Dallas, TX –

Gathersburg, MD –

Portland, OR –

We do not offer every plan available in your area. Currently we represent 12 organizations which offer 51+ products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Aetna HUMANA Anthem KAISER Alignment MEDICO BCBS NC MOLINA Carefirst PacificSource Cigna PEOPLES HEALTH/UHC Clover SONDER Devoted UHC Highmark WELLCARE/CENTENE