Tips and Considerations

Universal Steps for Choosing Life and Health

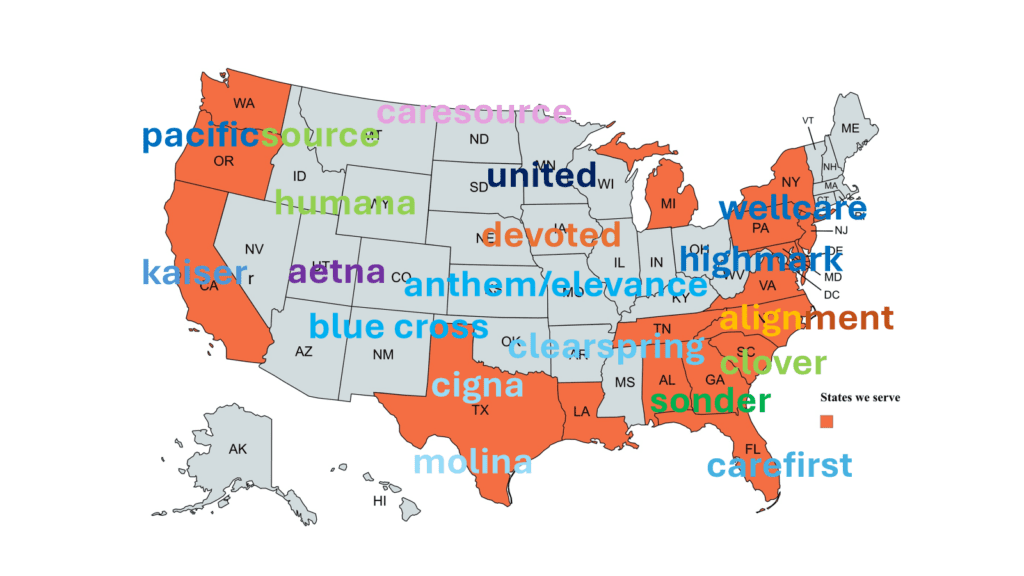

AL NY CA OR DE PA FL SC GA

TN LA TX MD WA MI NC NJ

Offices –

Charlotte, NC- 980-288-5798

Atlanta, GA – 678- 341-0931

Daytona, FL – 386-243- 2927

Knoxville, TN –

Dallas, TX –

Gathersburg, MD –

Portland, OR –

We do not offer every plan available in your area. Currently we represent 12 organizations which offer 51+ products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Aetna HUMANA Anthem KAISER Alignment MEDICO BCBS NC MOLINA Carefirst PacificSource Cigna PEOPLES HEALTH/UHC Clover SONDER Devoted UHC Highmark WELLCARE/CENTENE