Healthcare costs and subsidies are at the center of debates, business strategies, and household budgets in 2025. As prices climb at their fastest pace in over a decade, the role of government and employer subsidies has become even more critical to maintaining access and affordability. This article explores the latest trends in healthcare costs and the evolving landscape of subsidies in the United States.

The Escalating Cost of Healthcare

Healthcare spending in the U.S. continues its relentless rise. In 2023, total health spending grew by 7.5% to reach $4.9 trillion, or $14,570 per capita-a rate significantly higher than in previous years. For 2025, projections are even more sobering: employer-sponsored health coverage costs are expected to increase by 8–9%, surpassing $16,000 per employee on average. This marks the highest jump in more than a decade, with employers shouldering the burden of nearly $12,000 of that amount per worker in 2024, versus about $2,800 paid by employees themselves.

Several factors are fueling these increases:

Globally, the trend is similar, with medical costs projected to rise by 10.4% on average in 2025, and North America’s trend climbing from 8.1% in 2024 to 8.7% in 2025.

The Role and Evolution of Subsidies

As costs rise, subsidies-both public and private-are playing a larger role in keeping coverage accessible:

Employer Subsidies

Employers remain the primary source of health coverage for most Americans under 65. Despite rising costs, most large employers continue to absorb most premium increases to keep coverage affordable for employees. However, this strategy is under pressure, with some employers considering planning changes, higher cost-sharing, or new partnerships to manage expenses.

Subsidies and the ACA

On the individual market, the Affordable Care Act (ACA) has dramatically expanded subsidies. The American Rescue Plan (ARP) and Inflation Reduction Act (IRA) extended enhanced premium subsidies through 2025, eliminating the “subsidy cliff” and capping the cost of benchmark plans as a percentage of household income. As a result, 93% of Marketplace enrollees now receive premium subsidies, and some who were previously ineligible can now qualify.

Premiums for ACA Marketplace plans are projected to increase by a median of 7% in 2025, but subsidies are designed to rise alongside benchmark premiums, keeping net costs manageable for most enrollers. For example, average monthly subsidies grew from $526 in 2023 to $536 in 2024, with further increases expected as benchmark premiums rise.

Subsidy Dynamics

Strategies for Managing Costs

With costs rising, both employers and health systems are seeking new strategies to control spending:

Looking Ahead: Affordability and Uncertainty

The future of healthcare costs and subsidies remains uncertain. While enhanced ACA subsidies are set to continue through 2025, Employers are increasingly vocal about the unsustainable trajectory of costs, which is beginning to affect business investments and employee benefits.

For consumers, the key takeaways are:

In summary, healthcare costs are rising at their fastest pace in over a decade, driven by inflation, new therapies, and increased utilization. Subsidies-both employer-based and through the ACA-are more important than ever, but the system faces significant challenges in maintaining affordability and access. The coming years will test the resilience of both public and private coverage models as stakeholders seek solutions to a growing cost crisis.

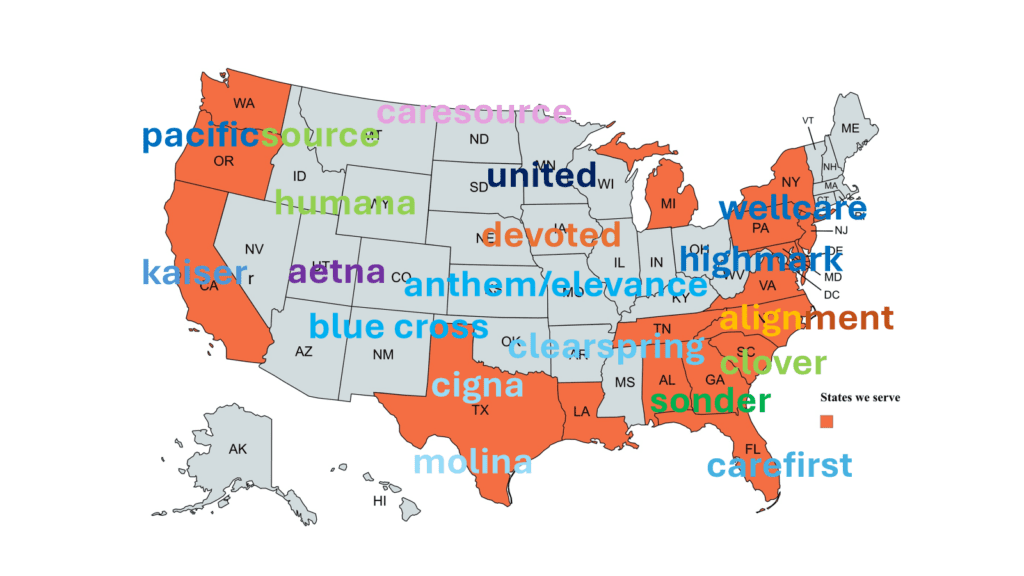

AL NY CA OR DE PA FL SC GA

TN LA TX MD WA MI NC NJ

Offices –

Charlotte, NC- 980-288-5798

Atlanta, GA – 678- 341-0931

Daytona, FL – 386-243- 2927

Knoxville, TN –

Dallas, TX –

Gathersburg, MD –

Portland, OR –

We do not offer every plan available in your area. Currently we represent 12 organizations which offer 51+ products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Aetna HUMANA Anthem KAISER Alignment MEDICO BCBS NC MOLINA Carefirst PacificSource Cigna PEOPLES HEALTH/UHC Clover SONDER Devoted UHC Highmark WELLCARE/CENTENE