Medicare covers hospital stays (Part A), doctor visits and outpatient care (Part B), prescription drugs (Part D), and additional benefits like dental or vision through Medicare Advantage (Part C).

Medicare is divided into Part A (hospital), Part B (medical/outpatient), Part C (Medicare Advantage), and Part D (prescription drugs).

You are eligible at age 65, or earlier if you have certain disabilities or conditions like ALS.

You can enroll starting three months before your 65th birthday, during your Initial Enrollment Period, or under special circumstances. Give Us a Call or Send Us an Email.

Most people pay $0 for Part A if they or their spouse worked 10 years, but there are premiums for Part B (about $174/month in 2025) and other parts, plus deductibles and copays.

Prescription drugs are covered under Part D or some Medicare Advantage plans, but not under Original Medicare (Parts A & B).

It depends on your employer coverage; you may delay some parts without penalty, but review your options carefully.

Original Medicare includes Parts A and B, while Medicare Advantage (Part C) is a private plan that may offer extra benefits like dental, vision, and prescription coverage.

Expect premiums, deductibles, copays, and coinsurance. Only Medicare Advantage plans have an annual out-of-pocket maximum; Original Medicare does not.

Yes, you can switch plans during annual enrollment periods or under certain qualifying events.

You must live in the U.S., be a citizen or lawfully present, not incarcerated, and not enrolled in Medicare.

There are multiple ways to enroll, but the easiest way would be to call or email us and we can hand hold you thru the process.

For 2025, open enrollment is November 1, 2024 to January 15, 2025 in most states.

A time outside open enrollment when you can sign up due to qualifying events like losing other coverage, marriage, or moving.

Premium subsidies and cost-sharing reductions are available based on income, usually for those earning 100%–400% of the federal poverty level or higher.

All ACA-compliant plans must cover ten essential health benefits, including emergency services, hospitalization, maternity, prescription drugs, and preventive care.

If your current plan meets ACA standards, you can keep it. The ACA also improves benefits and protections for most existing plans.

In-network providers cost less because they have agreements with your insurer. Out-of-network care is usually more expensive.

You pay a deductible before insurance pays; copays/coinsurance are your share of costs; the out-of-pocket max is the most you’ll pay in a year.

Report changes promptly to update your subsidy. You may need to repay excess subsidies if your income increases.

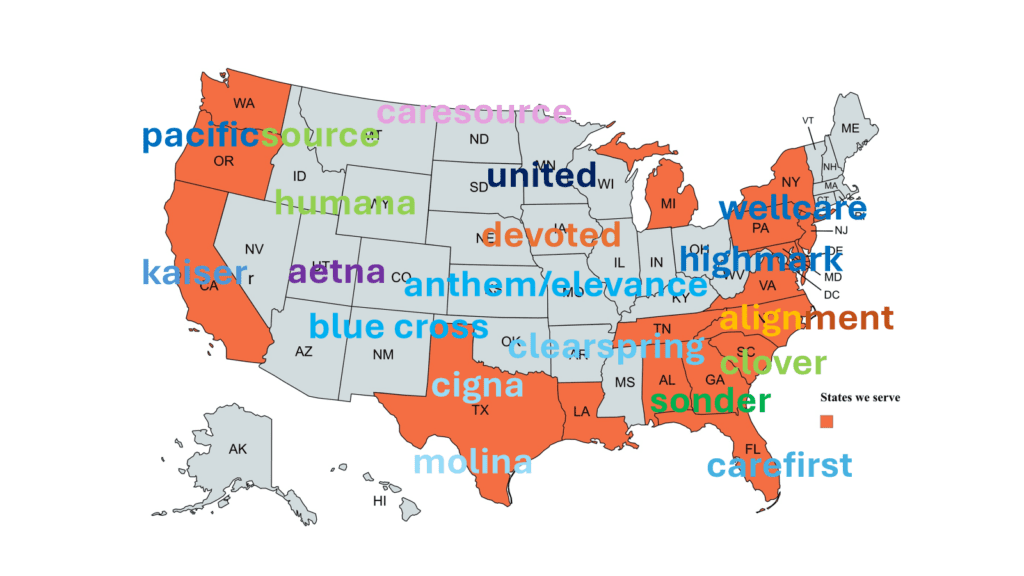

AL NY CA OR DE PA FL SC GA

TN LA TX MD WA MI NC NJ

Offices –

Charlotte, NC- 980-288-5798

Atlanta, GA – 678- 341-0931

Daytona, FL – 386-243- 2927

Knoxville, TN –

Dallas, TX –

Gathersburg, MD –

Portland, OR –

We do not offer every plan available in your area. Currently we represent 12 organizations which offer 51+ products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Aetna HUMANA Anthem KAISER Alignment MEDICO BCBS NC MOLINA Carefirst PacificSource Cigna PEOPLES HEALTH/UHC Clover SONDER Devoted UHC Highmark WELLCARE/CENTENE